Property Profile Diversification in New York: A Strategic Overview

Diversifying your realty portfolio is a keystone approach for long-term economic stability and growth. In New york city, a state known for its dynamic real estate market, the possibilities for diversity are large and fulfilling. Whether you're an skilled financier or simply starting, recognizing how to branch out properly in New York's market can set you on the course to success.

This overview will check out the advantages of profile diversification, essential methods, and possibilities specific to the New York realty market.

Why Expand Your Property Portfolio?

Diversification includes spreading financial investments throughout numerous asset types, places, and residential or commercial property classifications to decrease threat and make the most of returns. Right here's why it's vital:

1. Threat Reduction

Buying various property types or regions reduces the impact of market fluctuations on your portfolio.

2. Consistent Cash Flow

By diversifying, you can guarantee a stable earnings stream even if one market underperforms.

3. Funding Growth

Different markets and home types appreciate at varying prices, giving even more possibilities for lasting gains.

4. Financial Durability

A well-diversified portfolio can withstand economic declines by stabilizing risky and steady investments.

Opportunities genuine Estate Diversity in New York City

New York offers a range of property chances across urban, suv, and backwoods. Right here's a break down:

1. Urban Investments

New York City controls the metropolitan market with luxury homes, business areas, and high-demand rentals. Locations like Manhattan and Brooklyn are prime for high-income financiers seeking lasting recognition.

2. Rural Development

Suburban areas such as Westchester County and Long Island give chances in single-family homes, townhouses, and mid-tier services. These areas cater to family members and experts looking for closeness to NYC.

3. Upstate Properties

Upstate New york city, including cities like Albany and Buffalo, supplies budget-friendly investment choices. Multifamily units, holiday rentals, and business homes satisfy a growing need for affordable living and tourist.

4. Business Realty

From retail areas in dynamic urban facilities to industrial storehouses in the outskirts, industrial buildings in New York supply high-income potential with long-lasting lease Real estate portfolio diversification security.

5. Vacation Leasings

Tourist-heavy areas like the Catskills and Saratoga Springs are ideal for short-term leasings, specifically during peak seasons.

Methods for Expanding Your Portfolio in New York

1. Spend Throughout Property Types

Integrate household, business, and industrial homes to produce a well balanced profile.

Residential: Single-family homes, condos, or multifamily units.

Commercial: Workplace, retail shops, and mixed-use growths.

Industrial: Stockrooms or producing facilities, specifically in growing suburban areas.

2. Check Out Geographic Diversity

Avoid placing all your financial investments in one city or area. New york city State's varied landscape supplies possibilities in city and backwoods.

3. Consider Market Trends

Stay updated on financial growths, framework tasks, and movement patterns to recognize arising markets in New york city.

4. Usage REITs for More Comprehensive Direct Exposure

Realty Investment Company (REITs) supply an chance to purchase massive homes without straight possession, spreading your danger across multiple assets.

Advantages of Diversifying in New York's Market

1. High Need Throughout Markets

New York's diverse economy ensures solid demand for domestic, commercial, and commercial buildings.

2. Long-Term Recognition

Residence in essential locations like New York City and the Hudson Valley historically appreciate, supplying durable returns in time.

3. Tourism-Driven Markets

Temporary leasings in traveler locations like Lake Placid or Niagara Falls produce seasonal income and satisfy a expanding Airbnb market.

Challenges to Take into consideration

While New york city's real estate market is financially rewarding, diversification features difficulties:

High Initial Prices: Urban areas like New York City need substantial capital investment.

Regulations: Lease control laws and zoning guidelines may influence success.

Market Competitors: Popular regions usually have intense competitors for quality buildings.

Careful planning and due diligence are essential to conquering these challenges.

Study: Effective Profile Diversity

An capitalist started with a single-family home in Queens, NYC, producing rental earnings. To branch out:

They acquired a trip rental in the Adirondacks for seasonal income.

Added a industrial building in Syracuse, benefiting from the city's financial growth.

Invested in an commercial stockroom in Westchester for stable long-lasting leases.

This mix of residential property kinds and locations balanced their danger and raised overall returns.

Real estate profile diversification in New York is a tactical relocate to construct wealth and minimize danger. With its range of city, country, and country markets, New york city supplies something for every investor.

By exploring different home kinds, leveraging geographical variety, and remaining educated concerning market fads, you Real estate portfolio diversification can develop a resistant and profitable portfolio. Whether you're considering New York City's luxury apartment or condos or Upstate's inexpensive Real estate portfolio diversification multifamily units, the chances are unlimited.

Start diversifying your portfolio in New York today to secure your financial future!

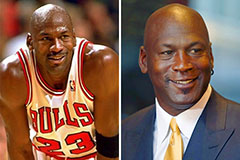

Michael Jordan Then & Now!

Michael Jordan Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!